Expenses // Creating expenses

Adding, editing and deleting of expenses can be done by all members of your account for the projects they are assigned to. They can only manage their own. Account managers can add expenses to all projects.

Creating an expense

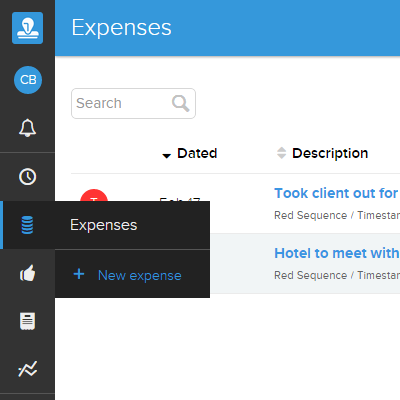

- Go to Expenses

- Click New expense button in the top-right of the screen (alternatively click the Expenses -> New expense menu item)

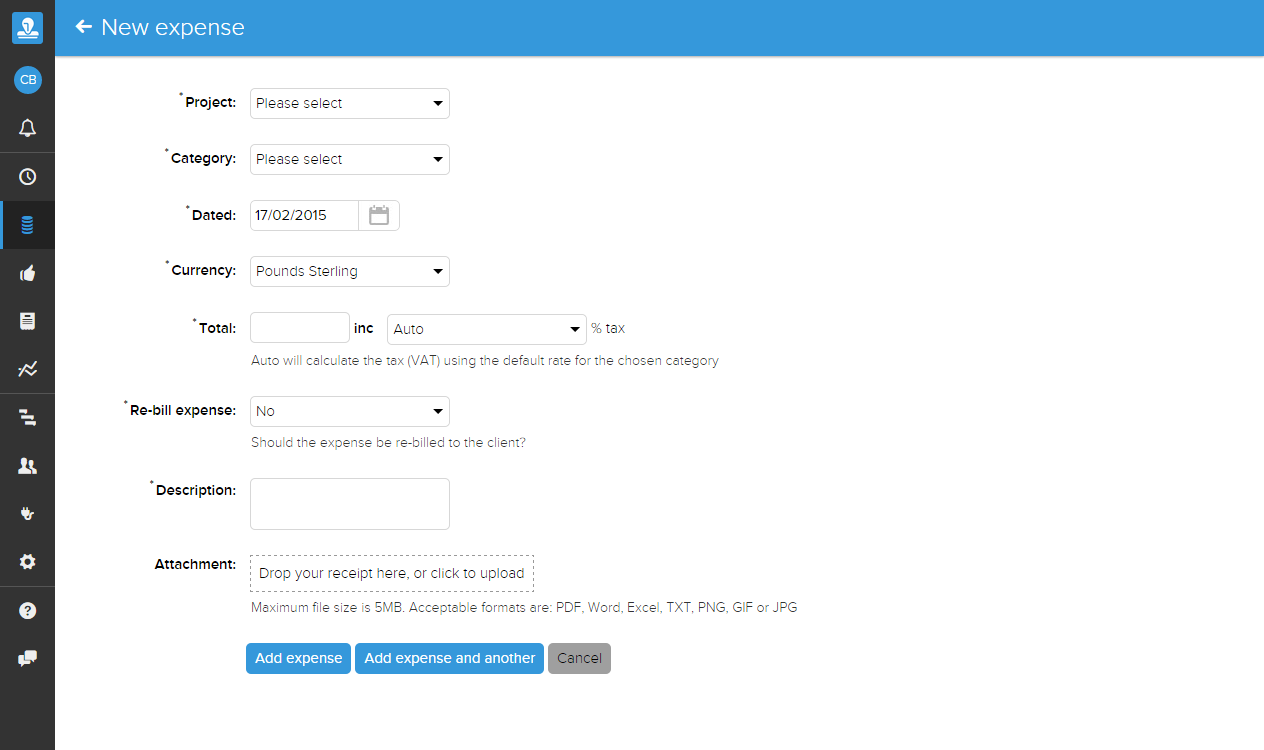

- Fill in the details of the expense, such as project, category and the total value

- Optionally upload an attachment (receipt). Some categories for your account may require an attachment

- Click New expense

Total value & tax

When entering the total value ensure that this is the value inclusive of VAT / Tax, and that the VAT rate is correctly set. Categories define an 'auto' VAT rate which should be used in the majority of cases, unless you know that it is being calculated incorrectly or you need to override the auto value.

Description

Put a description of what this expense was for. You might also want to make a note of why you incurred it, particularly if it's a tax-sensitive expense such as business entertaining.

Rebilling an expense

An expense can be marked as rebilled to indicate that when invoiced the cost of this expense will be billed to that client. An expense can be marked as:

- Not rebilled: This expense will not be included in any invoices

- At cost: This expense will be billed to the client at the same amount as Total Value

- At specific cost: This expense will be billed at the amount you specify

- With percentage markup: This expense will be billed at total cost, plus the given percentage markup

Uploading an attachment

Some categories require an attachment, and if you wish to claim VAT back on an expense then a valid VAT reciept is required. Uploading an attachment is done by either clicking Drop your receipt here, or click to upload, or dragging a file to this area to immediately begin uploading that file.

Once an attachment has been uploaded you can add a receipt reference, useful for identifying the expense on the attachment if the attachment contains multiple claims. You can also mark an expense attachment as a VAT receipt, which can be used when reporting to determine if you could claim back VAT.

I've made a mistake entering my expenses

You can edit expenses until it has been invoiced or approved.